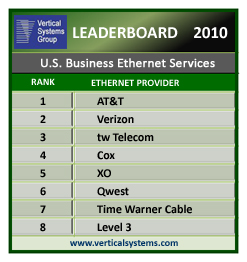

16 Aug Mid-2010 U.S. Business Ethernet LEADERBOARD

Top Leaderboard tier solidifies; Enterprise demand for Layer 2 Ethernet services drives 34% increase in U.S. port installations.

BOSTON, MA, JANUARY 26, 2010 —

AT&T, Verizon, tw Telecom, Cox, XO, Qwest, Time Warner Cable and Level 3 (in rank order) comprise Vertical Systems Group’s year-end 2010 U.S. Business Ethernet Leaderboard, according to  latest research on enterprise network installations. Vertical’s bi-annual Leaderboard ranks Ethernet service providers with four percent or more of the U.S. retail port base.

latest research on enterprise network installations. Vertical’s bi-annual Leaderboard ranks Ethernet service providers with four percent or more of the U.S. retail port base.

Research results also showed higher than expected market growth as enterprises were more confident about purchasing Layer 2 Ethernet services for their ultra-high bandwidth applications, particularly in the financial, education and state/local government segments. As a result, the U.S. Ethernet port base grew 34% in 2010, up from Vertical’s previous forecast of 31%.

“The top tier of the U.S. Leaderboard solidified during the past year, with AT&T, Verizon and tw Telecom accounting for half of the U.S. retail Ethernet port base. The remaining half of the market is served by the other Leaderboard providers plus more than sixty additional companies selling Ethernet services to U.S. business customers,” said Rick Malone, principal at Vertical Systems Group. “In 2010 there was also considerable market consolidation due to mergers and acquisitions, primarily among Tier 2 and Tier 3 providers. A common driver for these deals was acquiring fiber assets in order to expand network infrastructures and deepen direct fiber delivery of Ethernet services. Look for more of these transactions in 2011.”

Key results of Vertical’s latest share analysis:

-

-

Only three of the eight 2010 Leaderboard providers increased their port share as compared to the prior year.

-

Competitive Providers and Cable MSOs dominate the second tier of the Leaderboard.

-

XO edged out Qwest to move up to fifth position on the 2010 Leaderboard. Level 3 moved up to eighth position over Cogent, which dropped off the Leaderboard.

-

All other providers not represented on the Leaderboard account for nearly 20% of the 2010 U.S. retail Ethernet port base.

-

-

The number of U.S. ports delivered to enterprise sites through new Ethernet Exchanges was negligible in 2010.

Other providers delivering Business Ethernet services in the U.S. market include AboveNet, CenturyLink, Charter Business, Cogent, Comcast Business, Covad (a unit of MegaPath), Expedient, FiberLight, Frontier, Global Crossing, Lightower, Masergy, NTT, Optimum Lightpath, Orange, Paetec, Reliance Globalcom, Savvis, Sidera Networks (formerly RCN Metro), Sprint, SuddenLink, Windstream, Zayo Group and others.

Detailed share results plus in-depth Business Ethernet market statistics are available exclusively through Vertical Systems Group’s ENS(Emerging Networks Service) Research Programs.