10 Aug Mid-2012 U.S. Business Ethernet LEADERBOARD

Ethernet port base grew 24% in 2012; Ethernet access to IP VPNs and Cloud connectivity were the fastest growing applications.

BOSTON, MA, JANUARY 29, 2013 —

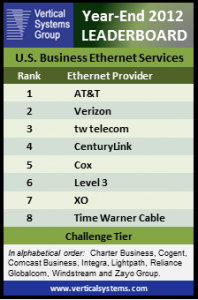

Vertical Systems Group’s U.S. Business Ethernet Leaderboard results for year-end 2012 are as follows (in rank order based on port share): AT&T, Verizon, tw telecom, CenturyLink, Cox, Level 3,  XO, and Time Warner Cable. Port shares were calculated using the base of enterprise installations of Ethernet services, plus input from Vertical’s independent surveys of Ethernet providers. The Leaderboard threshold is four percent (4%) or more of billable port installations.

XO, and Time Warner Cable. Port shares were calculated using the base of enterprise installations of Ethernet services, plus input from Vertical’s independent surveys of Ethernet providers. The Leaderboard threshold is four percent (4%) or more of billable port installations.

“The U.S. market for retail Ethernet ports rose 24% in 2012. The year was characterized by major backbone upgrades, new market rollouts, price wars and channel expansion. Ethernet access to IP VPNs and Cloud connectivity were the fastest growing applications,” said Rick Malone, principal at Vertical Systems Group. “Position changes on our Leaderboard include Level 3 moving up two spots, jumping ahead of XO and Time Warner Cable. AT&T and Verizon remain the top two providers, but not without challenges. AT&T experienced slower overall growth in Ethernet – especially in the second half of the year – and derived more Ethernet sales from wholesale partners. Verizon remained number two on our Leaderboard despite a challenging fourth quarter which resulted in loss of market share.”

Other providers selling Ethernet services in the U.S. are segmented into two tiers as measured by port share. The first or Challenge Tier for 2012 includes the following eight companies (listed here in alphabetical order): Charter Business, Cogent, Comcast Business, Integra, Lightpath, Reliance Globalcom, Windstream (includes Paetec) and Zayo Group (includes AboveNet).

The second or Market Player tier covers other providers offering Ethernet services in the U.S. The Market Player tier includes the following companies (listed in alphabetical order): Alpheus Communications, American Telesis, Bright House Networks, BT Global, Cincinnati Bell, Consolidated Communications, EarthLink Business, Expedient, FairPoint, FiberLight, Fibertech, Frontier, Hawaiian Telecom, IP Networks, Lightower, LS Networks, Lumos Networks, Masergy, Megapath, NTT America, Orange Business, Sidera Networks, Spirit, Sprint, SuddenLink, TDS, US Signal, Virtela and others.

Detailed Ethernet market share results for the U.S. market and by provider segment (Incumbent Carrier, Competitive Provider, Cable MSO) plus in-depth share analysis are available now exclusively through Vertical Systems Group’s ENS (Emerging Networks Service) Research Programs.

LEADERBOARD Market Share Methodology

Vertical Systems Group’s LEADERBOARDs are the industry’s foremost benchmarks for measuring Ethernet Service Provider market presence based on billable retail port installations. Share results are calculated at year-end and mid-year for the U.S. and Global Provider markets. Year-end results additionally include U.S. provider share analysis for three separate segments: Incumbent Carrier, Competitive Provider, and Cable MSO. For releases and more information on methodology, see LEADERBOARDs.

About Vertical Systems Group

Vertical Systems Group’s ENS Research Programs provide a cloud-based resource with hundreds of research topics, plus analyst support for your ad hoc requests or consultations. Contact us for subscription information and pricing.

Vertical Systems Group is recognized worldwide as a leading market research and strategic consulting firm specializing in defensible quantification of the networking industry. For more information see www.verticalsystems.com and follow us on Twitter for research alerts. To speak to an analyst at Vertical Systems Group, please contact us.