12 Feb 2013 U.S. Carrier Ethernet LEADERBOARD

Aggressive service pricing intensifies in metro markets and Cable MSOs gain ground

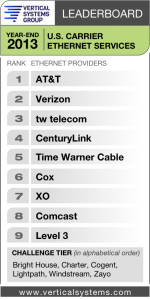

BOSTON, MA, FEBRUARY 12, 2014 – Vertical Systems Group’s U.S. Carrier Ethernet LEADERBOARD results for year-end 2013 are as follows (in rank order based on retail ports): AT&T,  Verizon, tw telecom, CenturyLink, Time Warner Cable, Cox, XO, Comcast and Level 3. Port shares were calculated using the base of enterprise installations of Ethernet services, plus input from Vertical’s independent surveys of Ethernet providers. The Leaderboard threshold is four percent (4%) or more of billable port installations.

Verizon, tw telecom, CenturyLink, Time Warner Cable, Cox, XO, Comcast and Level 3. Port shares were calculated using the base of enterprise installations of Ethernet services, plus input from Vertical’s independent surveys of Ethernet providers. The Leaderboard threshold is four percent (4%) or more of billable port installations.

The fastest growing application for 2013 continues to be Ethernet access to IP/MPLS VPNs, a capability supported by each of the Incumbent Carrier and Competitive Provider companies ranked on the LEADERBOARD. For Gigabit speed Ethernet services, the top applications were connectivity to Data Centers and Cloud services.

A key business concern cited by Ethernet providers is disruptive service pricing in major U.S. metro markets. Competition for new business intensified during the past year as regional Ethernet providers and Cable MSOs focused on share gain. This trend is expected to continue throughout 2014.

Cable MSOs gained ground on the 2013 U.S. LEADERBOARD. Time Warner Cable moved up just ahead of Cox to gain the top Cable MSO provider position. Comcast moved up from the Challenge Tier, and was the fastest growing of all ranked companies.

“Cable companies have developed a winning formula for the U.S. business Ethernet market,” said Rick Malone, principal at Vertical Systems Group. “They are successfully leveraging their on-net fiber footprints to offer aggressive pricing and rapid service provisioning.”

Other providers selling Ethernet services in the U.S. are segmented into two tiers as measured by port share. The first or Challenge Tier includes providers with between 1% and 4% share of the U.S. retail Ethernet market. For 2013, the following six companies attained a position in the Challenge tier (in alphabetical order): Bright House Networks, Charter, Cogent, Lightpath (formerly Optimum Lightpath), Windstream and Zayo.

The second or Market Player tier includes all providers with port share below 1%. Companies in the Market Player tier include the following providers (in alphabetical order): Alpheus Communications, American Telesis, BT Global Services, Cbeyond, Cincinnati Bell, Consolidated Communications, Earthlink Business, Expedient, FairPoint Communications, FiberLight, Fibertech, Frontier, Hawaiian Telecom, Integra Telecom, Lightower, LS Networks, Lumos Networks, Masergy, Megapath, NTT America, Orange Business, RCN Business, Reliance Globalcom, Sprint, SuddenLink, Tata, TDS Telecom, TelePacific, US Signal, WOW!Business and other companies selling retail Ethernet services in the U.S. market.

Detailed Ethernet share results for the U.S. market plus in-depth share analysis are available now exclusively through Vertical Systems Group’s ENS (Emerging Networks Service) Research Programs.

- Click here for related STATFLash U.S. Ethernet Service Ports Jump 26% in 2013 LEADERBOARD analysis shows port growth driven by Ethernet access to IP/MPLS VPNs and Cloud connectivity; Top providers already MEF CE 2.0 certified