24 Aug Mid-Year 2015 U.S. Carrier Ethernet LEADERBOARD

Port growth unprecedented in the first half of 2015; Mergers may shake up the market by the end of the year

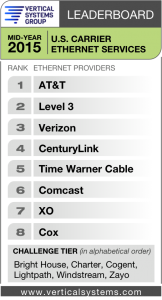

BOSTON, MA, AUGUST 24, 2015 – Vertical Systems Group’s U.S. Carrier Ethernet LEADERBOARD results for mid-2015 are as follows (in rank order based on retail port share): AT&T, Level 3, Verizon, CenturyLink, Time Warner Cable, Comcast, XO and Cox. Port shares were calculated using the base of enterprise installations of Ethernet services, plus input from surveys of Ethernet providers. The LEADERBOARD threshold is four percent (4%) or more of billable  port installations.

port installations.

“U.S. Ethernet port growth was unprecedented in the first half of 2015 and easily surpassed previous estimates. This market seems to be defying the law of large numbers, as there are few indications of the typical slowing growth patterns that we look for when services reach this size and maturity,” said Rick Malone, principal at Vertical Systems Group. “Primary drivers for growth are massive migration from TDM to Ethernet services, robust demand for higher speed Ethernet private lines and rising requirements for connectivity to public and private Clouds.”

Other providers selling Ethernet services in the U.S. are segmented into tiers as measured by port share. The Challenge Tier includes providers with between 1% and 4% share of the U.S. retail Ethernet market. The following six companies attained a position in the mid-2015 Challenge Tier (in alphabetical order): Bright House, Charter, Cogent, Lightpath, Windstream and Zayo.

Pending mergers could shake up the Ethernet marketplace by the end of 2015. In April 2015, Comcast ended its bid to acquire Time Warner Cable in the face of strong consumer opposition and regulatory hurdles. In May, Charter announced a merger that includes both Time Warner Cable and Bright House. Currently pending regulatory approval, this deal has the potential to change the U.S. Ethernet competitive landscape as significantly as Level 3’s acquisition of tw telecom in 2014. Both Charter and Bright House are Challenge Tier companies. Time Warner Cable is ranked fifth on the Mid-2015 U.S. Carrier Ethernet LEADERBOARD.

The Market Player tier includes all providers with port share below 1%. Companies in the Market Player tier include the following providers (in alphabetical order): Alpheus Communications, American Telesis, Birch Communications, BT Global Services, Cincinnati Bell, Consolidated Communications, Earthlink Business, Expedient, FairPoint, FiberLight, Fibertech (acquired by Lightower, August 2015), Frontier, Global Capacity, Global Cloud Xchange, GTT, Hawaiian Telecom, Integra, Lightower, LS Networks, Lumos Networks, Masergy, MegaPath, NTT America, Orange Business, RCN Business, Sprint, SuddenLink, Tata, TDS Telecom, TelePacific, Telstra, US Signal, WOW!Business and other companies selling retail Ethernet services in the U.S. market.

Detailed Ethernet share results for the U.S. market plus in-depth share analysis are available now exclusively through Vertical Systems Group’s ENS (Emerging Networks Service) Research Programs.