27 Oct Worldwide Carrier Ethernet Port Demand Recovers as Revenue Growth Slows

By Rosemary Cochran, Principal & Co-Founder, Vertical Systems Group

Carrier Ethernet continues to be the strategic data service delivered by network providers throughout the world to customers requiring higher speed, high performance, secure connectivity. Expansion of the Ethernet services market was abruptly stifled in early 2020 when the COVID pandemic started to spread globally, initiating a slump that has altered the outlook for growth through 2025.

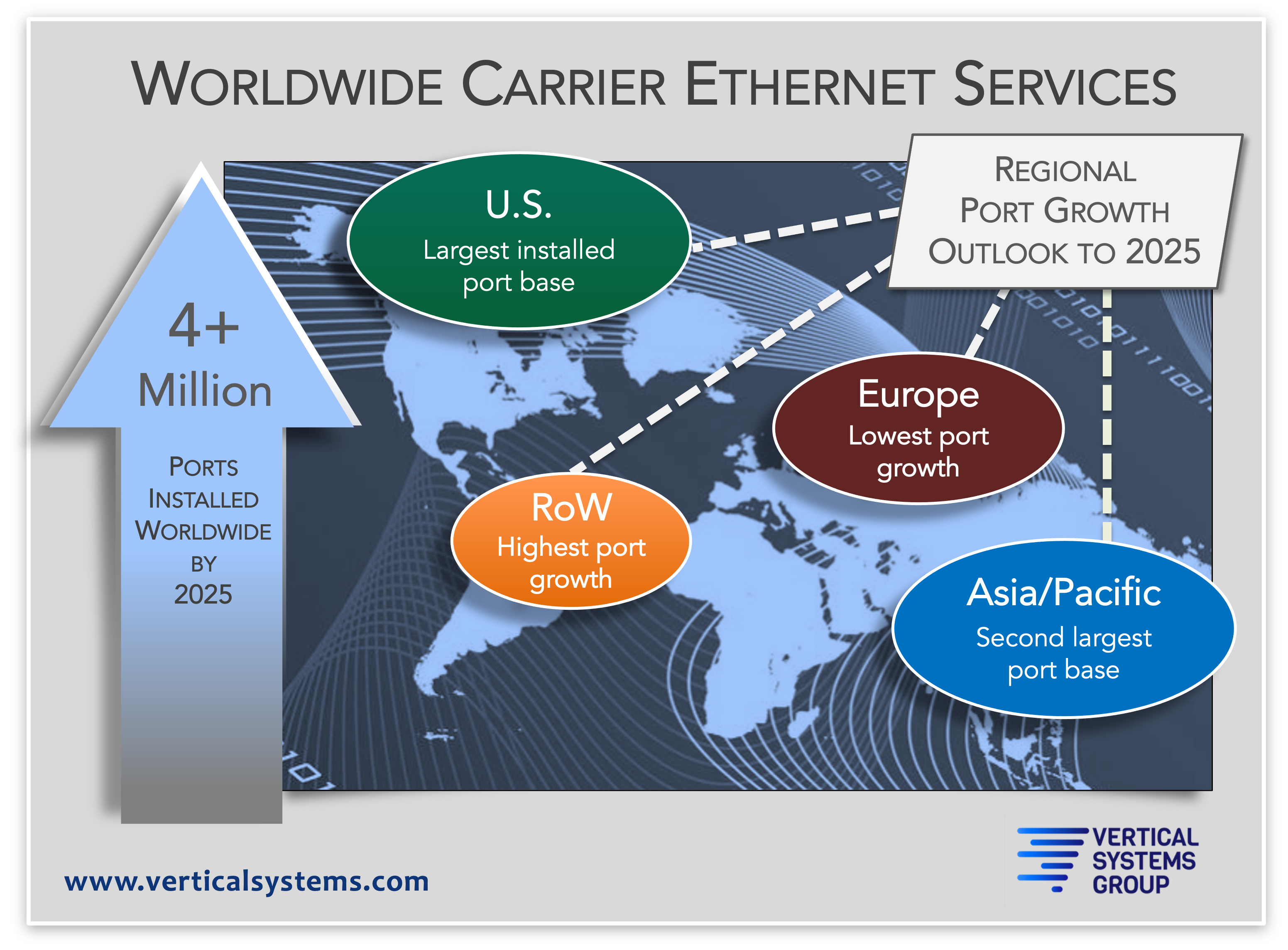

Demand for Ethernet services varies considerably across the four regions tracked by Vertical Systems Group – U.S., Asia/Pacific, Europe, and Rest of World (RoW). In addition to the devastating effects of the global pandemic, inhibitors to Ethernet market growth encompass regional and country-specific economic, political, and regulatory factors.

New research incorporating these dynamics shows that demand for Ethernet services is recovering as customers focus on network transformations to accommodate future bandwidth and application requirements. Installations of retail Ethernet services are projected to reach more than four million ports worldwide by 2025. The outlook for revenue growth during this time period is restrained by price compression, delayed customer payments, and supply chain issues. Ten additional key research results are summarized below.

10 Key WW Carrier Ethernet Research Results

-

The U.S. is the largest regional market with more than one million customer port installations. Steady port expansion is projected through 2025, following minimal net new growth in 2020 due to pandemic-related mandates and business closures.

-

Asia/Pacific, the second largest region based on Ethernet ports, spans more fifty countries with widely varying economic conditions. Although port growth for this region dipped in 2020, the projected outlook is positive annual increases between 2021 and 2025.

-

Europe has the lowest projected compound annual growth rate (CAGR) for Ethernet ports through 2025. Hardest hit by the pandemic, this region endured the most erosion of its Ethernet port base in 2020.

-

RoW is the least developed and fastest expanding regional market for Ethernet services. This region has the smallest port base with the highest CAGR between 2020 and 2025.

-

Asia/Pacific generated the most Carrier Ethernet revenue through 2020. The U.S. is projected to edge past Asia/Pacific in 2021 and continue through 2025 as the top region based on revenue.

-

The RoW has the highest revenue CAGR overall. Europe is the only regional market with a negative CAGR for revenue during the projection period.

-

Accessibility to optical fiber is essential for high speed Ethernet deployments, so providers are filling fiber gaps in country markets worldwide. Ongoing 5G expansion is also driving new fiber builds, which boosts opportunities to deliver gigabit speed Ethernet services.

-

Currently the primary challenges to Ethernet growth are market maturity and competition from alternative technologies. The most potentially disruptive alternatives are Managed SD-WAN solutions, Wavelength services, and dark fiber.

-

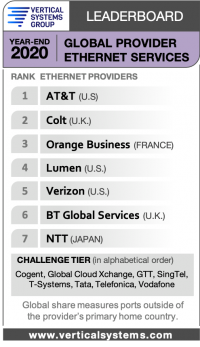

Vertical’s LEADERBOARDs are the industry’s foremost benchmarks for measuring leadership based on Service Provider market share results. Seven companies achieved a rank position on the Year-End 2020 Global Provider Ethernet LEADERBOARD as follows: AT&T (U.S.), Colt (U.K.), Orange Business Services (France), Lumen (U.S.), Verizon (U.S.), BT Global Services (U.K.) and NTT (Japan).

-

Notably many leading Global Ethernet providers are also top-ranked or cited based on market share for Managed SD-WAN services on our Mid-2021 Global Provider Carrier Managed SD-WAN Services LEADERBOARD.

Detailed projections for Worldwide Carrier Ethernet revenue and ports by region through 2025, plus the market share detail that powers the LEADERBOARDs are available exclusively to ENS Research Program subscribers. Latest research incorporates the effects of COVID-19 and the Delta variant. Contact us for more information.