15 Feb 2022 U.S. Carrier Ethernet LEADERBOARD

AT&T regains #1 share position after five year hiatus; Lumen drops to #2 rank

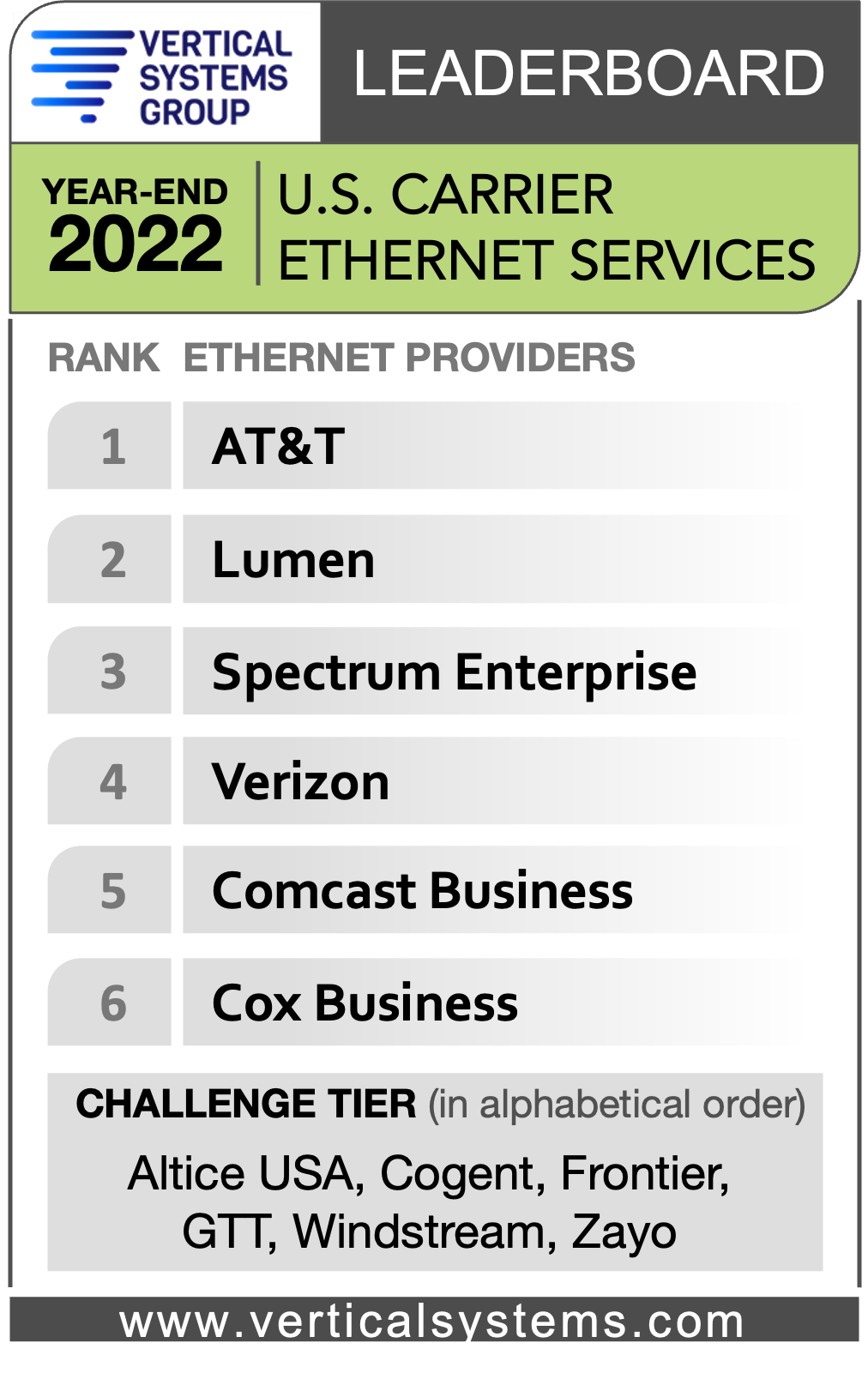

BOSTON, MA, February 16, 2023 – Vertical Systems Group announces that the following six companies achieved a position on the year-end 2022 U.S. Carrier Ethernet LEADERBOARD (in rank order based on retail port share as of December 31, 2022): AT&T, Lumen, Spectrum Enterprise, Verizon, Comcast Business and Cox Business. Network providers must have four percent (4%) or more of the U.S. retail Ethernet services market to qualify for a rank on this LEADERBOARD.

Challenge Tier citations were attained by the following six companies (in alphabetical order): Altice USA, Cogent, Frontier, GTT, Windstream and Zayo. The Challenge Tier includes providers with between 1% and 4% share of the U.S. retail Ethernet market.

“Dedicated Internet Access (DIA) became the largest and fastest growing segment of the U.S. Ethernet market in 2022. Although the total market grew only by low single digits, DIA was in high demand as a reliable underlay service supporting enterprise network transformations to SD-WAN/SASE, as well as for secure, dedicated access to cloud-based services,” said Rick Malone, principal of Vertical Systems Group.

2022 U.S. Ethernet Market Analysis

- AT&T moved ahead of Lumen to gain the top position on the 2022 U.S. Ethernet LEADERBOARD. Shares tightened between other leading companies, however without impact on the rank positions for year-end 2022.

- Lumen fell to second position on this LEADERBOARD as a result of service declines and the spinoff of assets to Brightspeed. Lumen (formerly CenturyLink) previously ranked first continuously starting in 2017 when it acquired Level 3.

- DIA is the top performing service across the six Ethernet segments tracked by Vertical Systems Group. Our research shows declining or no significant growth for the other five segments, including Ethernet Private Lines, Ethernet Virtual Private Lines, E-Access to VPN, Metro LAN, and WAN VPLS.

- Demand for Gigabit Ethernet services is robust for applications requiring dedicated high capacity and low latency, such as connectivity to data centers. Alternatives to Ethernet for enterprise customers with these requirements include Wavelength services and Dark Fiber.

- Challenges cited by Ethernet service providers include ongoing supply chain issues, price compression, customer migration to SD-WAN and broadband services, an expanding competitive landscape, and economic uncertainties.

- Lumen and Verizon have attained MEF 3.0 Carrier Ethernet (CE) certification.

The Market Player tier includes all providers with port share below 1%. Companies in the Market Player tier include the following providers (in alphabetical order): ACD, AireSpring, Alaska Communications, Alta Fiber, American Telesis, Arelion, Armstrong Business Solutions, Astound Business, Breezeline, Brightspeed, BT Global Services, Centracom, Consolidated Communications, Conterra, Crown Castle, DFN, DQE Communications, Everstream, Exa Infrastructure, Fatbeam, FiberLight, First Digital, FirstLight, Flo Networks, Fusion Connect, Global Cloud Xchange, Great Plains Communications, Hunter Communications, Intelsat, Logix Fiber Networks, LS Networks, MetTel, MetroNet Business, Midco, Momentum Telecom, NTT, Orange Business, Pilot Fiber, PS Lightwave, Ritter Communications, Segra, Shentel Business, Silver Star Telecom, Sparklight Business, Syringa, T-Mobile, Tata Communications, TDS Telecom, TPx, Unite Private Networks, Uniti, US Signal, WOW!Business, Ziply Fiber and other companies selling retail Ethernet services in the U.S. market.

@Ethernet is available now exclusively by subscription to an ENS Research Program. Research data includes the market share detail that powers the U.S. and Global Provider Carrier Ethernet Services LEADERBOARD results. Contact us for more information and pricing.