12 Dec Blog: Demand Surging for Gigabit Ethernet Ports

By Rosemary Cochran

Principal & Co-Founder, Vertical Systems Group

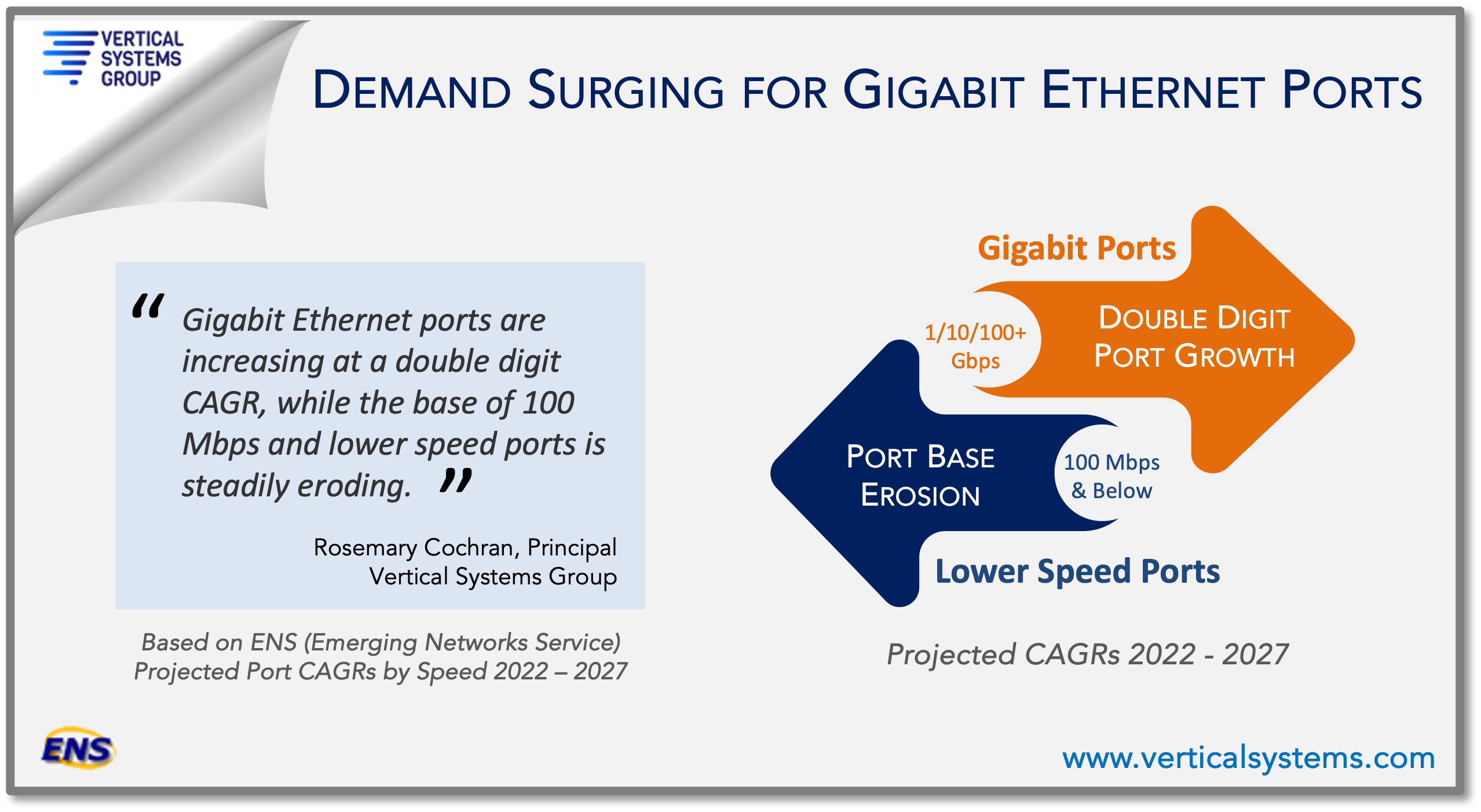

BOSTON, MA, December 12, 2023 – Demand is surging for gigabit speed commercial services across the U.S., driven by customer requirements for higher capacity network connectivity. Gigabit Ethernet ports are increasing at a double-digit CAGR, while 100 Mbps and lower speed ports are steadily eroding. Based on current growth rates, Gigabit ports will exceed the number of Ethernet ports at 100 Mbps & Below rates by 2027.

Gigabit revenue is now fueling most of the $18 billion U.S. Carrier Ethernet services market, and solidly outpacing lower speed revenue contributions. This view incorporates the impact of price compression, as well as ongoing customer migration to other services. With the exception of DIA (Dedicated Internet Access), price erosion is affecting these five other Ethernet service segments included in Vertical’s research analysis – i.e., Ethernet Access to IP/MPLS, EPL (Ethernet Private Lines), EVPL (Ethernet Virtual Private Lines), Metro LAN, and WAN VPLS (Wide Area Network Virtual Private LAN Service).

The big picture is that DIA is the top service for 1+ Gbps speed revenue, and the predominant service for gigabit speed underlays supporting U.S. Carrier Managed SD-WAN customer networks. EPL services are the second largest source of gigabit revenue, driven by enterprise applications requiring low latency, point-to-point circuits for secure, dedicated access to Cloud services.

Outlooks for Gigabit Ethernet

What are the port and revenue outlooks for the three commercial gigabit speed segments – 1 Gbps, 10 Gbps, and 100+ Gbps?

- 1 Gbps is the most widely installed gigabit service based on port installations, as well as the top revenue source through 2027 across all Ethernet services. However, the revenue outlook ahead is eroding growth as customers upgrade to higher speed Gigabit Ethernet ports or migrate to other alternatives such as Wavelength services.

- 10 Gbps ports are increasing at a healthy double-digit growth rate through 2027 due to service upgrades and expanding market demand. Revenue for this speed segment is projected to steadily rise, and nearly double between 2022 and 2027.

- 100+ Gbps has a relatively small, but rapidly developing port base. The outlook for this segment is accelerating customer requirements for higher speed connectivity, due in part to competitively lower pricing (per Gbps). Revenue is projected to increase by almost 5x between 2022 and 2027.

Gigabit Ethernet Migration and Beyond

Challenges to Ethernet market growth include migration to other services, including Carrier Managed SD-WAN and SASE, Wavelength services, and Dark Fiber.

Carrier Managed SD-WAN/SASE customers in the U.S. utilize a mix of access connections, and predominately Broadband and Ethernet DIA. SD-WAN customers opt for Ethernet DIA to support applications requiring secure, gigabit speed, symmetrical connectivity. Some customers choose broadband access connections due to relatively lower costs and widespread availability.

Wavelength services up to 400+ Gbps are becoming more generally available as an alternative to gigabit Ethernet. These services address business-critical applications by providing managed, dedicated circuits with pre-determined latency. Large enterprises, telecom carriers, and hyperscale network providers are using wavelengths for backbone networks and IT cloud transformations.

Dark Fiber is another alternative to gigabit Ethernet services. This solution utilizes dedicated fiber for customers requiring custom designed connectivity, or proprietary application interfaces. These offerings may include operations and termination equipment costs that are the responsibility of the customer or service provider.

Today nearly two-thirds of retail U.S. Ethernet connections are delivered over direct optical fiber. However, the need for business fiber expansion continues. More than 1.4 million U.S. commercial buildings and data centers already have carrier-grade fiber connectivity.

For service providers, fiber lit buildings are strategic assets that afford the advantages of delivering services faster and more profitably. Notably all of the Ethernet service providers ranked on Vertical’s Mid-2023 U.S. Carrier Ethernet LEADERBOARD also rank as leading fiber providers on the latest U.S. Fiber Lit LEADERBOARD.

Source: ENS Research Program excerpts from @Ethernet, @SD-WAN, @Wavelength, and @Fiber.

Vertical Systems Group’s industry-leading research is available exclusively by subscription to a custom ENS Research Program. Research Tracks feature unlimited access to defensible statistics and projections through 2027, in-depth migration analysis, and LEADERBOARD market share results. Programs include hundreds of data tables, charts, and infographics – plus bundled expert Analyst Advisory support from our experienced team. Contact us now for information and special year-end pricing offers.