26 Mar 2018 U.S. Fiber Lit Buildings LEADERBOARD

Latest benchmark rankings for providers with 10,000+ fiber lit commercial buildings

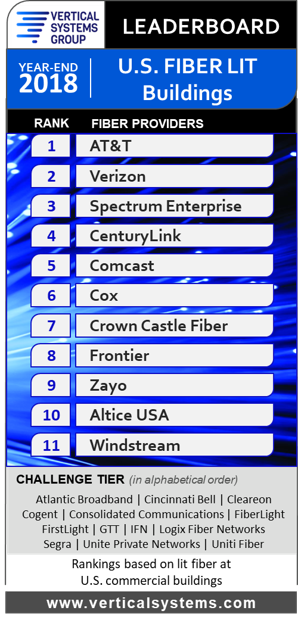

BOSTON, MA, March 28, 2019 – Vertical Systems Group’s 2018 U.S. Fiber Lit Buildings LEADERBOARD results are as follows (in rank order by number of fiber lit buildings): AT&T, Verizon, Spectrum Enterprise, CenturyLink, Comcast, Cox, Crown Castle Fiber, Frontier, Zayo, Altice USA, and Windstream. These eleven retail and wholesale fiber providers qualify for this benchmark with 10,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2018.

BOSTON, MA, March 28, 2019 – Vertical Systems Group’s 2018 U.S. Fiber Lit Buildings LEADERBOARD results are as follows (in rank order by number of fiber lit buildings): AT&T, Verizon, Spectrum Enterprise, CenturyLink, Comcast, Cox, Crown Castle Fiber, Frontier, Zayo, Altice USA, and Windstream. These eleven retail and wholesale fiber providers qualify for this benchmark with 10,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2018.

Additionally, thirteen companies qualify for the 2018 Challenge Tier as follows (in alphabetical order): Atlantic Broadband, Cincinnati Bell, Cleareon, Cogent, Consolidated Communications, FiberLight, FirstLight, GTT, IFN, Logix Fiber Networks, Segra, Unite Private Networks, and Uniti Fiber. These fiber providers each qualify for the 2018 Challenge Tier with between 2,000 and 9,999 U.S. fiber lit commercial buildings.

“Following a flurry of mergers and acquisitions, fiber providers focused on new buildouts in 2018 to meet customer demand for higher speed dedicated access to business services and to support 5G pilots,” said Rosemary Cochran, principal of Vertical Systems Group. “Our research shows that while the majority of large and medium size commercial buildings in the U.S. are fiber lit with one or more providers, relatively few small multi-tenant buildings are fiber connected. Cable MSOs and regional network operators have been most actively targeting fiber investment opportunities in this underserved segment.”

Fiber Provider Research Summary

- AT&T ranks #1 on the Fiber Lit Buildings LEADERBOARD for the third consecutive year.

- Frontier moves into the #8 position, up from ninth in the prior year.

- As a result, Zayo falls to #9, down from eighth position.

- Windstream enters the LEADERBOARD at #11, moving up from the Challenge Tier.

- Atlantic Broadband and GTT advance to the Challenge Tier, both moving up from the Market Player tier.

- Cincinnati Bell’s acquisition of Hawaiian Telecom, which was completed in 2018, is reflected in this analysis.

- Segra is the new brand name for the merged entity of Lumos Networks and Spirit Communications.

Market Players includes all other fiber providers with fewer than 2,000 U.S. commercial fiber lit buildings. The 2018 Market Players tier includes more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): Armstrong, C Spire, Centracom, Conterra, CTS Telecom, DQE Communications, EnTouch Business, Everstream, ExteNet Systems, Fatbeam, Fusion Telecom, Google Fiber, Hunter Communications, Infostructure, LS Networks, Mediacom Business, MetroNet Business, Monmouth Telecom, Orca Communications, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Syringa, TDS Telecom, TPX Communications, U.S. Signal, Veracity, WOW!Business and others.

For this analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

Fiber LEADERBOARDs, the industry’s foremost benchmark for measuring market leadership, are powered by the results of Vertical Systems Group’s Fiber Lit Buildings analysis by provider. Detailed metrics, fiber provider profiles, and analysis are available now exclusively to ENS Research Program subscribers of @Fiber Plus. Contact us for subscription information and pricing.