31 Aug Mid-2023 U.S. Carrier Managed SD-WAN LEADERBOARD

Leading U.S. providers tackle complexities of offering SD-WAN, SASE, and SSE solutions with multiple suppliers

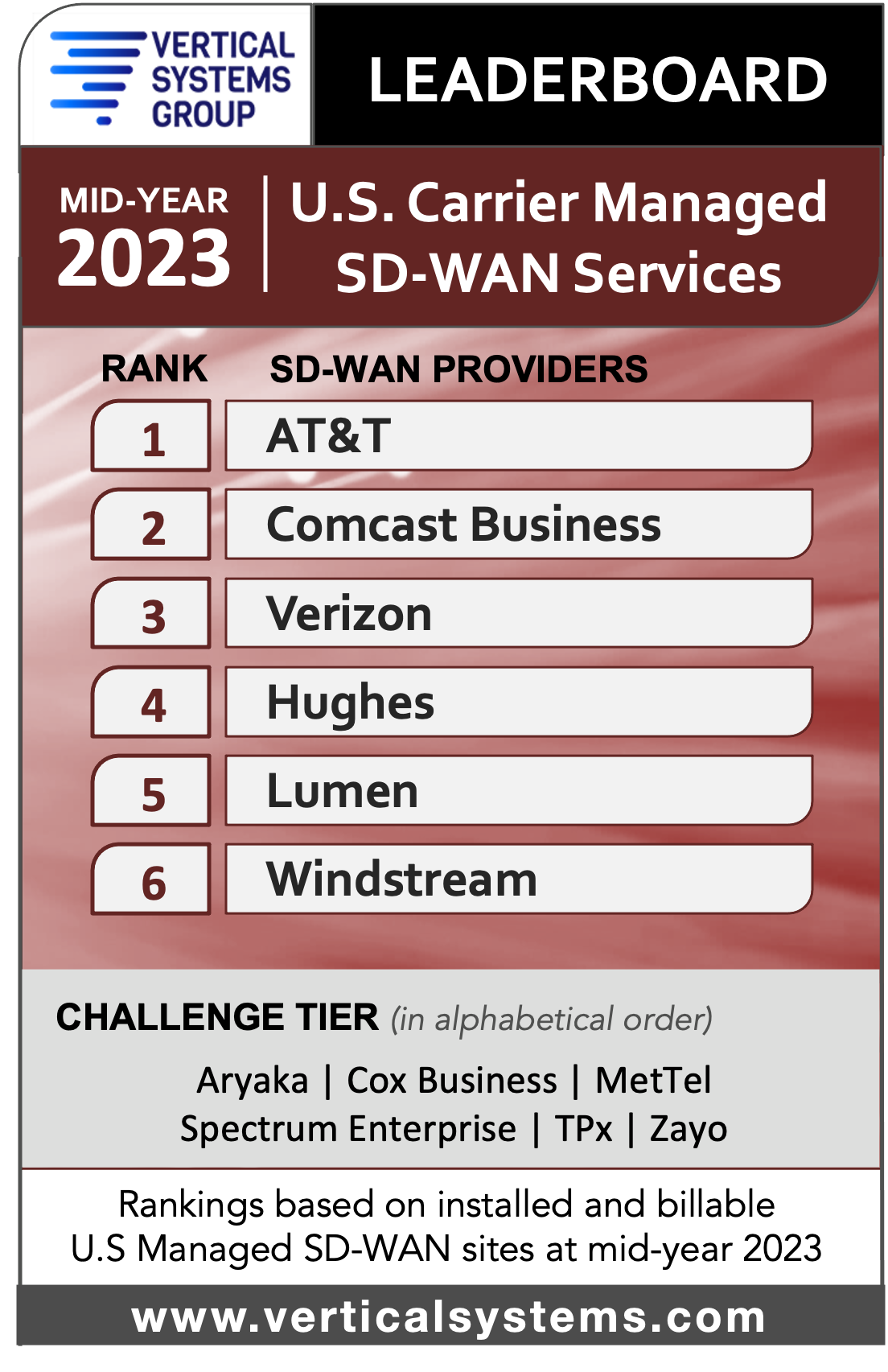

BOSTON, MA, AUGUST 31, 2023 – Vertical Systems Group announces that six companies qualify for a position on the mid-year 2023 U.S. Carrier Managed SD-WAN Services LEADERBOARD as follows (in rank order based on site share): AT&T, Comcast Business, Verizon, Hughes, Lumen and Windstream. Each of these service providers has four percent (4%) or more of the billable Carrier Managed SD-WAN customer sites installed in the U.S. as of June 30, 2023.

“During the first half of 2023, supply chain improvements led to the fulfilling of a large backlog of SD-WAN orders,” said Rick Malone, principal of Vertical Systems Group. “As the number and size of customer networks grow, service providers are experiencing unanticipated challenges such as network complexity, vendor interoperability and customer education.”

Six companies attain a Challenge Tier citation for mid-year 2023 as follows (in alphabetical order): Aryaka, Cox Business, MetTel, Spectrum Enterprise, TPx and Zayo. Providers in this tier have between one percent (1%) and four percent (4%) share of U.S. Carrier Managed SD-WAN sites.

Mid-2023 Research Highlights

- Rosters for the U.S. Carrier Managed SD-WAN LEADERBOARD and the Challenge Tier changed due to new thresholds for calculating site shares. A LEADERBOARD rank requires four percent (4%) or more of U.S. sites installed, up from two percent (2%) previously. Challenge Tier citations require a site share between one percent (1%) and four percent (4%).

- The six SD-WAN LEADERBOARD companies for mid-year 2023 retain their respective rank positions unchanged from year-end 2022.

- TPx, Zayo, and Aryaka drop from the LEADERBOARD ranks into the mid-2023 Challenge Tier.

- Three companies retain their Challenge Tier share citations as follows (in alphabetical order): Cox Business, MetTel, and Spectrum Enterprise.

- Two companies drop from the Challenge Tier into the Market Player tier based on site share: Fusion Connect and Cogent (includes Sprint assets from T-Mobile).

- Market leading providers utilize technologies from multiple different suppliers for their SD-WAN, SASE, and SSE solutions. This broad range of options is making solution integration more complex, the sales process more demanding, and customer purchase decisions more protracted.

- Five of the six Mid-Year 2023 U.S. LEADERBOARD companies have attainted MEF 3.0 SD-WAN Service Certification as follows: AT&T, Comcast Business, Verizon, Lumen, and Windstream. The only Challenge Tier provider with MEF 3.0 SD-WAN Certification is Spectrum Enterprise.

Market Players include all other providers selling Carrier Managed SD-WAN services in the U.S. with site share below one percent (1%), including global network providers that manage U.S. customer sites. For mid-2023, the Market Player tier includes the following companies (in alphabetical order): AireSpring, Alta Fiber, American Telesis, Arelion, Astound Business, Bigleaf, BT Global Services, C Spire Business, CentraCom, Cogent, Colt, Consolidated Communications, Crown Castle, DQE Communications, First Digital, FirstLight, Flo Networks, Frontier, Fusion Connect, Granite Telecom, Great Plains Communication, GTT, InfoStructure, Intelsat, Lightpath, Logix Fiber Networks, Meriplex, Momentum Telecom, NTT, Orange Business, PCCW Global, PS Lightwave, Ritter Communications, SDN Communications, Segra, SES, Shentel Business, SingTel, Sparklight Business, Syringa, T-Systems, Tata Communications, Telefonica, Telstra, Unite Private Networks, Uniti, US Signal, Virgin Media Business, Vodafone, WiLine, Ziply Fiber and others.

Vertical Systems Group’s Definition: Carrier Managed SD-WAN Service

Vertical Systems Group defines a Carrier Managed SD-WAN Service for segment analysis and share calculations as a carrier-grade offering for business customers that is managed by a network operator. Required components and functionality for these offerings include an SDN service architecture that provides dynamic optimization of traffic flows, a purpose-built SD-WAN appliance or CPE-hosted SD-WAN VNF at each customer edge site, support for multiple active underlay connectivity services, automated failover fast enough to maintain active sessions, and centralized network orchestration with traffic and application visibility end-to-end. Security is the most essential additional managed SD-WAN service capability that may be provided or integrated based on specific customer requirements.

@SD-WAN is available now exclusively by subscription to an ENS Research Program. Research data includes the market share detail that powers the U.S. and Global Provider Carrier Managed SD-WAN Services LEADERBOARD results. Contact us for more information and pricing.