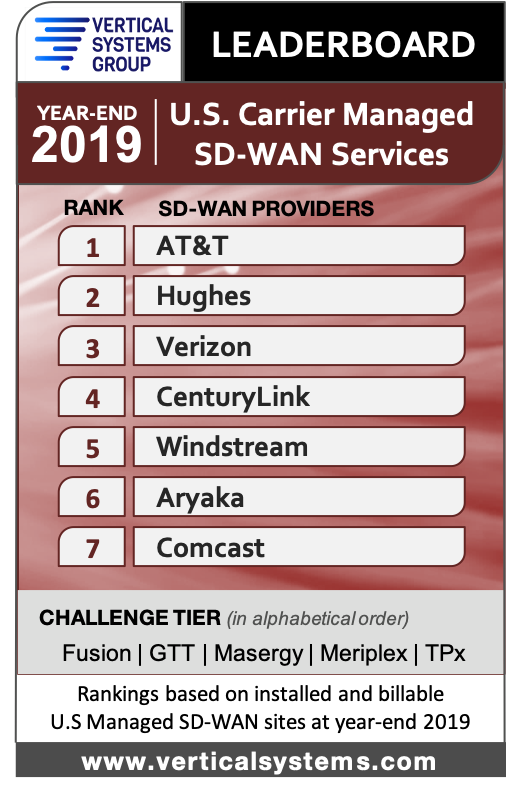

21 Apr 2019 U.S. Carrier Managed SD-WAN LEADERBOARD

AT&T, Hughes and Verizon retain top three share positions; CenturyLink advances to fourth position

BOSTON, MA, April 22, 2020 – Vertical Systems Group announced today that the following companies achieved a position on the 2019 U.S. Carrier Managed SD-WAN Services LEADERBOARD benchmark (in rank order based on site share): AT&T, Hughes, Verizon, CenturyLink, Windstream, Aryaka and Comcast. These seven service providers each have two percent (2%) or more of installed and billable Carrier Managed SD-WAN customer sites in the U.S. as of year-end 2019.

“The U.S. managed SD-WAN market expanded rapidly in 2019 as backlogged orders from the prior year were fulfilled by key service providers,” said Rick Malone, principal of Vertical Systems Group. “While the duration and depth of the coronavirus economic collapse is unknown, we expect resiliency across bandwidth intensive VPN markets, but acute vulnerability for the SD-WAN networks supporting the retail and travel verticals.”

Five companies attained a Challenge Tier citation for 2019 (in alphabetical order): Fusion, GTT, Masergy, Meriplex and TPx. The Challenge Tier includes service providers with between one percent (1%) and two percent (2%) share of U.S. Carrier Managed SD-WAN sites.

YE 2019 Research Highlights

- Billable U.S. installations of Carrier Managed SD-WAN Services increased 89% in 2019. As projected in our prior research, large businesses and enterprises are increasingly relying on service providers to help configure, implement and manage their SD-WAN deployments.

- AT&T, Hughes and Verizon retained the top three LEADERBOARD positions for the second consecutive year.

- There were several significant share shifts compared to the prior year results. CenturyLink advanced to fourth position, which dropped Windstream from fourth to fifth position. Comcast moved up to seventh position from eighth in 2018. Fusion dropped off the LEADERBOARD into the Challenge Tier for 2019.

- Bigleaf and Sprint, which were both cited in the 2018 Challenge Tier, dropped into the 2019 Market Player tier.

- Comcast is the only service provider on the U.S. LEADERBOARD that has attained MEF 3.0 SD-WAN Services certification. This market differentiator assures compliance with the MEF 70 global standard for SD-WAN managed services.

- Five leading technologies enable the SD-WAN services offered by the 2019 U.S. Carrier Managed LEADERBOARD plus Challenge Tier providers – VMware by VeloCloud, Cisco vEdge (Viptela), Cisco Meraki MX, Fortinet and Versa. Additionally, several SD-WAN providers utilize their own internally developed technologies.

- Versa is the only one of these suppliers that has achieved MEF 3.0 SD-WAN Technology certification to date.

Market Players include providers selling Carrier Managed SD-WAN services in the U.S. with site share below one percent (1%), including global network providers that manage U.S. customer sites. For 2019, the Market Player tier included the following companies (in alphabetical order): AireSpring, Bigleaf, BT, CBTS, Cincinnati Bell, Cogent, Colt, Consolidated Communications, Cox, DQE Communications, FirstLight, Frontier, Intelsat, MetTel, Neutrona, NTT, Orange Business, PCCW Global, PS Lightwave, RCN Business, SES, SDN Communications, Segra, SingTel, Spectrum Enterprise, Sprint, Syringa, T-Systems, Tata, Telefonica, Telia Carrier, Veracity Networks, Virgin Media Business, Vodafone, Zayo and others.

Vertical Systems Group defines a Carrier Managed SD-WAN Service as a carrier-grade offering for business customers that is managed by a network operator, utilizes an SDN architecture, enables dynamic customer edge site connectivity, and provides centralized network control and visibility end-to-end.

@SD-WAN is available now exclusively by subscription to an ENS Research Program. Research includes the market share detail that powers the Carrier Managed SD-WAN Services LEADERBOARD. Content quantifies market revenue, billable sites, customer counts, WAN access connections, pricing by WAN Access type, site configuration analysis, migration drivers to SD-WAN, customer purchase drivers, service provider challenges, technology suppliers by SD-WAN provider, Directories of Managed SD-WAN Services for both network operators and technology suppliers – and more. Contact us for more information and pricing.