24 Feb 2020 U.S. Carrier Ethernet LEADERBOARD

Lumen, AT&T and Spectrum Enterprise retain the top three positions; Ethernet port growth flattened by COVID-19 in 2020

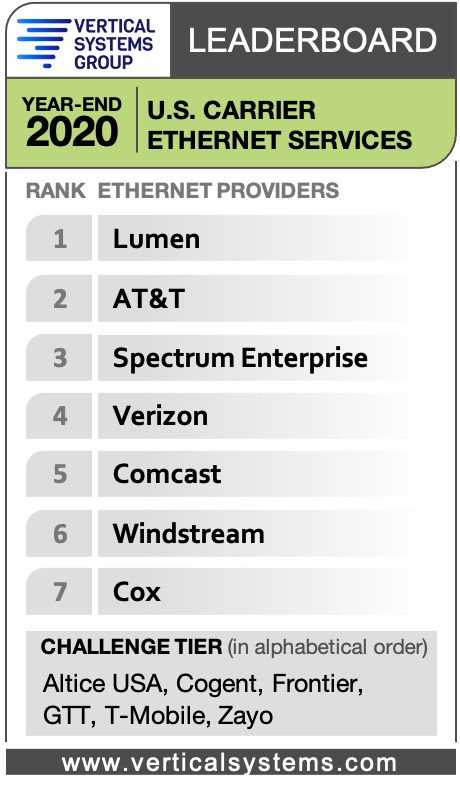

BOSTON, MA, FEBRUARY 24, 2021 – Vertical Systems Group announces that the following seven companies achieved a position on the 2020 U.S. Carrier Ethernet LEADERBOARD (in rank order based on retail port share as of December 31, 2020): Lumen, AT&T, Spectrum Enterprise, Verizon, Comcast, Windstream and Cox. To qualify for a rank on this LEADERBOARD, network providers must have four percent (4%) or more of the U.S. retail Ethernet services market.

Six network providers attained a Challenge Tier citation (in alphabetical order): Altice USA, Cogent, Frontier, GTT, T-Mobile (includes Sprint) and Zayo. The Challenge Tier includes providers with between 1% and 4% share of the U.S. retail Ethernet market.

“U.S. Ethernet port growth was flat in 2020 as service implementations were disrupted by COVID-19, and enterprises pivoted from Ethernet-connected MPLS networks to Managed SD-WANs,” said Rick Malone, principal of Vertical Systems Group. “The major bright spot during the past year has been rising demand for secure, multi-gigabit Ethernet connectivity to data centers and other high traffic sites.”

Market shares are measured based on the number of billable retail customer ports installed. Vertical Systems Group’s Ethernet port share analysis includes six service segments based on what service providers are offering and enterprise customers are purchasing as follows: Ethernet DIA (Dedicated Internet Access), E-Access to IP/MPLS VPN, Ethernet Private Lines, Ethernet Virtual Private Lines, Metro LAN, and WAN VPLS.

2020 U.S. Market Analysis

- Lumen (formerly CenturyLink) has ranked first on the U.S. Ethernet LEADERBOARD continuously since 2017. To date, the company is the only ranked service provider that has attained MEF 3.0 CE (Carrier Ethernet) certification.

- Spectrum Enterprise employs the largest number of MEF Carrier Ethernet Certified Professionals (MEF-CECPs) across all U.S. Ethernet LEADERBOARD companies.

- Nearly one-quarter of retail Ethernet services installed in the U.S. are 1 Gbps or higher speed ports.

- The Ethernet segment most severely impacted by COVID-19 in 2020 was E-Access to IP/MPLS VPN, which has a widely installed U.S. port base.

- The fastest growing Ethernet segment is DIA, which is one of the preferred underlay services supporting dedicated connectivity for Managed SD-WANs.

The Market Player tier includes all providers with port share below 1%. Companies in the Market Player tier include the following providers (in alphabetical order): AireSpring, Alaska Communications, American Telesis, Atlantic Broadband, bSimplify, BT Global Services, Cincinnati Bell, Consolidated Communications, Crown Castle Fiber, DQE Communications, FiberLight, FirstLight, Fusion Connect, Global Cloud Xchange, Great Plains Communications, Logix Fiber Networks, FirstComm, LS Networks, Masergy, MetTel, Midco, Momentum Telecom, NTT, Orange Business, RCN Business, Segra, Sparklight Business, Tata, TDS Telecom, Telstra, TPx, Unite Private Networks, US Signal, Wave Broadband, WOW!Business and other companies selling retail Ethernet services in the U.S. market.

@Ethernet is available now exclusively by subscription to an ENS Research Program. Research data includes the market share detail that powers the Carrier Ethernet Services LEADERBOARD results. Detailed analysis provides market projections for revenue and ports by six service segments and five speed segments, service pricing, key market trends, Directories of Ethernet providers worldwide – and more. Latest Ethernet research analysis incorporates the impact of COVID-19. Contact us for more information and pricing.