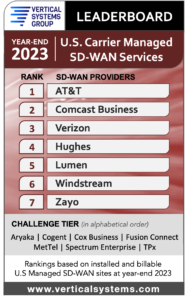

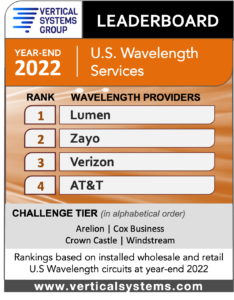

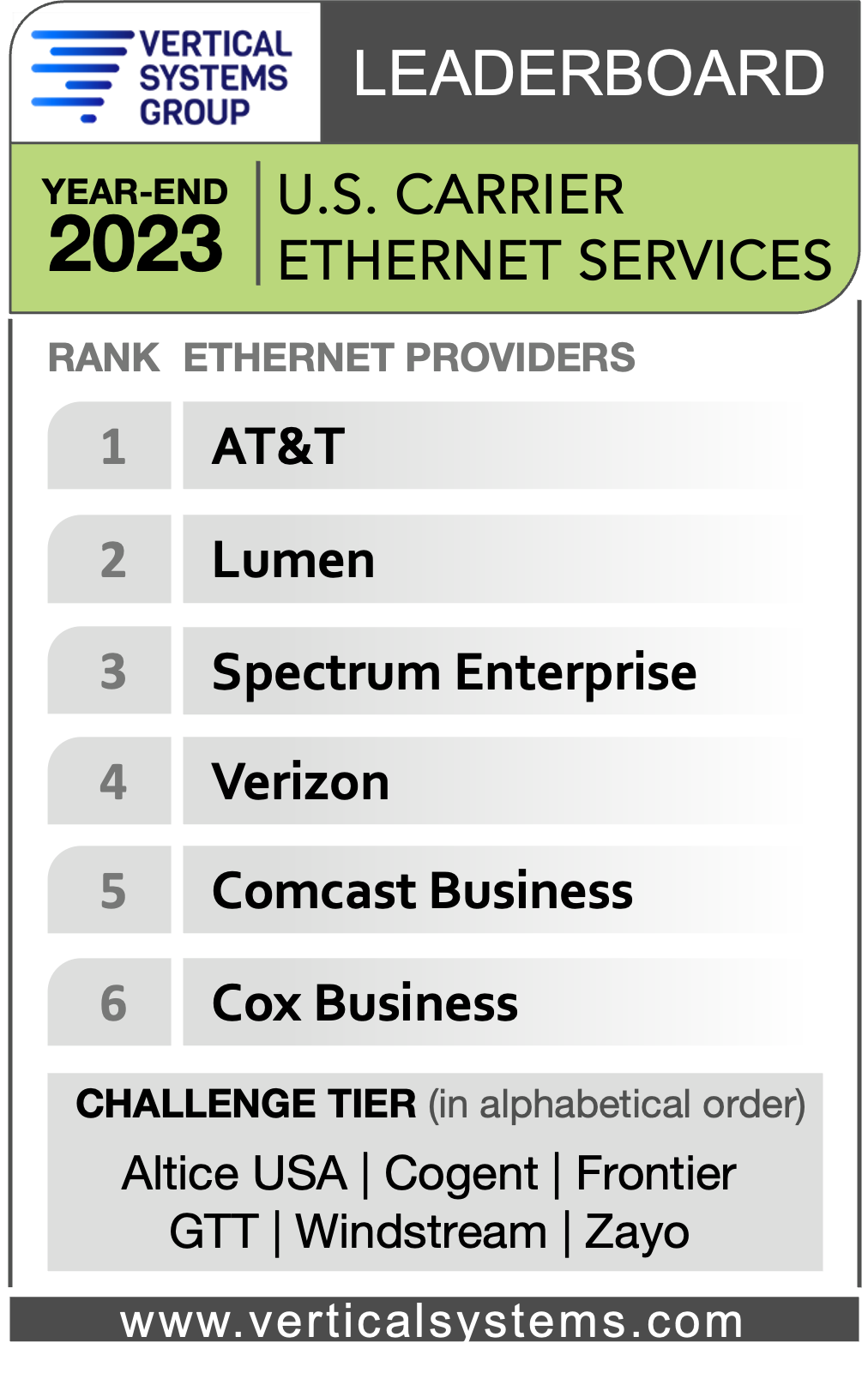

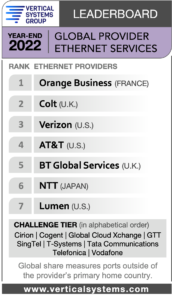

Vertical Systems Group’s LEADERBOARDs are the industry’s foremost benchmarks for measuring market leadership for Carrier Ethernet Services, Carrier Managed SD-WAN Services, Wavelength Services and Business Fiber Lit Buildings. Public LEADERBOARD releases show the rank order of top Service Providers based on market share results, plus Challenge Tier citations and recognition for Market Player companies in alphabetical order

All LEADERBOARD results are based solely on Service Provider market shares. Vertical does not charge a fee to license or distribute LEADERBOARD results.

ENS Research Program subscribers have access to detailed market share data and analysis.